Unleashing the Power of Crypto Insights with Token Metrics:

In the insta-growing and fast-changing world of cryptocurrencies, access to up-to-date and accurate data and knowledge is crucial in making sound investment decisions. Token Metrics, which is an AI- and machine learning-driven platform, is spearheading this advocacy by providing users with critical insights and forecasts into the crypto landscape.

Token Metrics will let you see how this platform is working.

Token Metrics is a pioneering avant-garde platform whose main aim is to analyze and forecast market predictions in the crypto world with ultramodern AI and machine learning algorithms. Token Metrics aggregates data from various sources and through high-end models provides users with an extensive view of the whole crypto space, enabling users to make better investment decisions. These features have made Token Metrics a stupendous hit among both traditional and retail traders. read more

With AI Insights:

The platform analyzes massive data using AI algorithms to see the unnoticed trends in traditional analysis-centric markets. Thus, it provides insights with a great edge.

Predictive Analytics of the Market:

The predictive analytical toolset within Token Metrics can provide analyses based upon forecasting probable market movements, helping the users anticipate likely price changes and act promptly in decision-making.

Comprehensive Research:

Token Metrics delivers nuanced research reports on different cryptocurrencies ranging from fundamental analysis to technical indicators in assessments, enabling users to realize much better when approaching different assets they may be interested in.

Science of Portfolio Analysis and its Management:

The platform enables the user to create and manage their bitcoin portfolio by providing personalized recommendations based on the investment goal and risk tolerance level of the user.

Free Education Materials:

Token Metrics provides very good educational content regarding general tutorials, readings, and videos, which may bolster users in enhancing their knowledge in the crypto space, decision-making processes, and choice-making too. sing up here:

Benefits of Using Token Metrics

Informed Decision-Making: With its AI-driven insights and comprehensive research, Token Metrics equips users with the necessary information to make informed investment decisions, thus reducing risks in the volatile crypto market.

Time Savings: Analyzing the crypto market is time-consuming. Token Metrics helps the user streamline this process by providing them with ready-to-use insights and predictions.

Increased Confidence: Once provided with reliable data and predictive analytics, the user has greater confidence in making investments, earning them the hope of navigating the markets. increased confidence like pro

Cryptocurrency Analysis: Unlocking the Secrets of the Digital Gold Rush

The cryptocurrency, the recent developments in digital currency, has revolutionized the financial sector by creating new investment opportunities while changing the very perception that surrounds money. Nevertheless, every investor is counseled into carrying out deeper, more thorough analysis before diving into the cryptocurrency market because of the volatile nature of cryptocurrencies. Such an analysis revolves around understanding the essential elements that would influence the market decision within the crypto asset. The bits of analysis can further be divided into two main parts: fundamental analysis and technical analysis.

Fundamental Analysis

While fundamental analysis is predicated on the understanding of forces that drive the value of the cryptocurrency, such as the team behind the project, the technology, its use case, demand for the market, and overall trends in the industry. Key features of fundamental analysis include:

The Whitepaper: serves as the project guide; it is a document in which information concerning all areas related to the project, namely its aims, technology, and roadmap, are clearly stated; if well written, the whitepaper would guide potential investors concerning its credibility and chances of success.

The Team and Advisors: studying carefully the knowledge and experience levels of the various team members directly related to the project, as well as those of advisors, would allow for a well-balanced discussion about how capable the team is in executing its vision.

Partnerships and Collaborations: strong collaborations and partnerships with other reputable organizations also further strengthen the project itself.

Community and Social Media Presence: the project’s popularity and growth potential can be gauged from the perspective of a large and active community. Social media platforms such as Twitter, Reddit, and Telegram serve as good places to evaluate community feelings.

Market Demand and Use Case: A good idea of a real-world and, more importantly, a long-term use case would help in the evaluation of a project’s complete competence in the market. read more:

Technical Analysis

Technical analysis primarily relies on graphs and data history to predict the movement of price trends. This method uses indications and a range of instruments, such as:

Price Charts: Analyzing price charts generally identifies some patterns and trends such as support and resistance levels, which usually fills the basis of some of the investment decisions.

Moving Averages: For determining trend-tracking indicators, it smoothens the price action. There are many types of moving averages; the noteworthy ones are the simple moving average (SMA) and the exponential moving average (EMA).

Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. It helps identify overbought and oversold market conditions.

Volume: Volume analysis provides insight into the strength and sustainability of price movements. Very high volume indicates strong investor interest and confidence in the market.

Candlestick Patterns: Candlestick charts provide an indication of price movements and help identify potential reversals or continuation patterns.

Combining Both Approaches While the divergent views between the fundamental and technical analysis, combining both will provide a rational view related to the potential of the coin. Assessing the intrinsic value will complement knowing the market behavior, thus resulting in broad-based decision-making and assessing the risk in accordance with the investor’s trade style. read more:

Conclusion

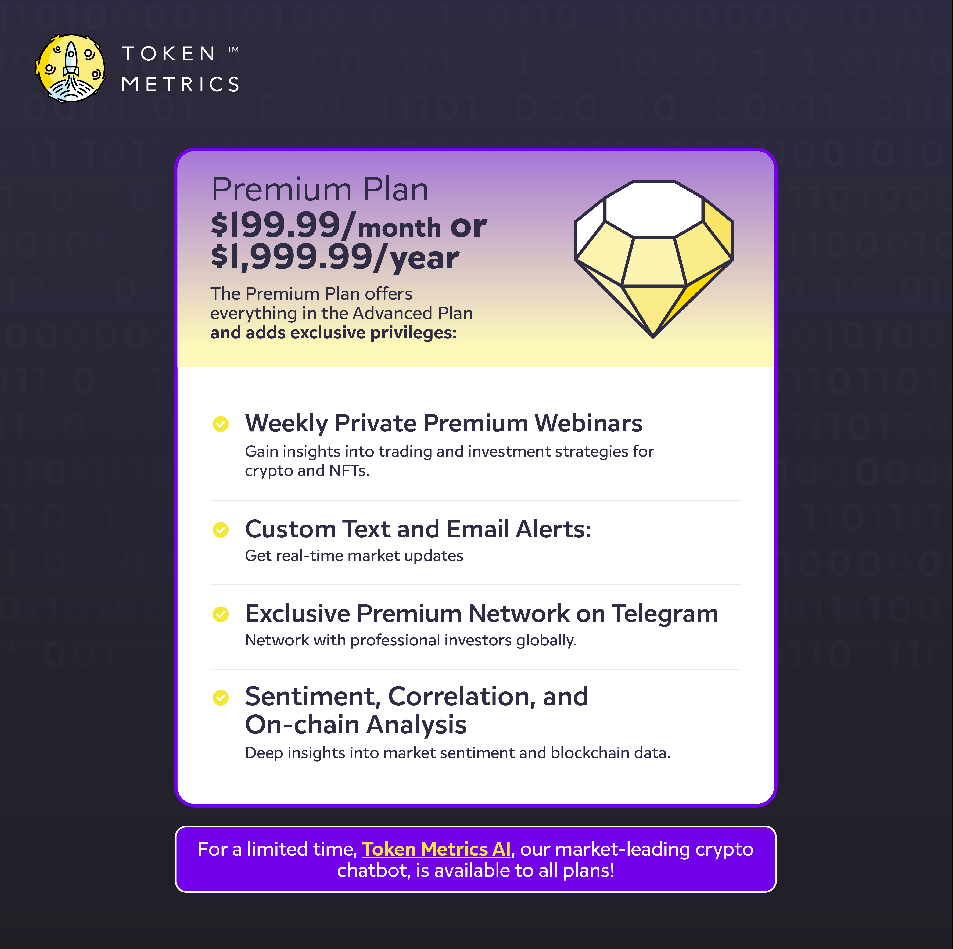

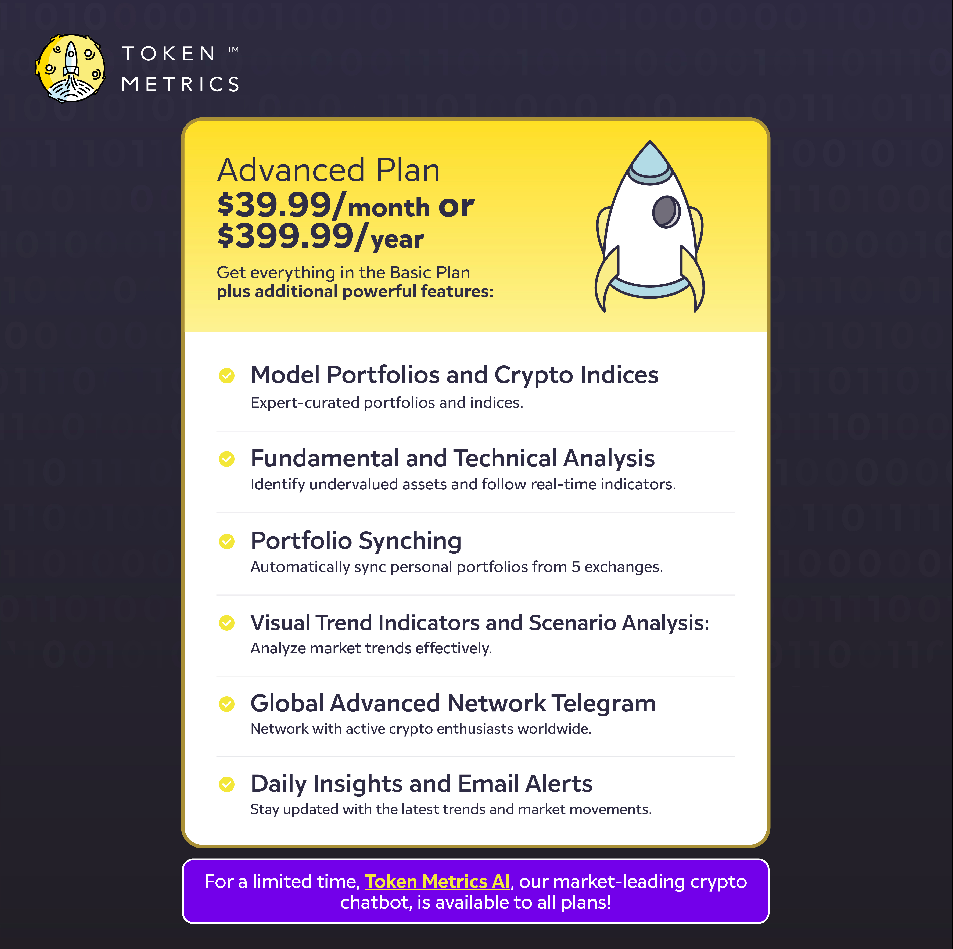

Token Metrics is reinventing how investors scan the cryptocurrency market. Using artificial intelligence and machine learning, it provides users with unprecedented insights and predictive analytics so they can make smarter decisions. Whether you’re an experienced investor or a newcomer to the crypto world, Token Metrics gives you everything you need to help you navigate this consistently transforming market.

Cryptocurrency analysis is one of the most useful ways to play the complicated and often unpredictable waters of digital assets. Using both the fundamental and technical analysis approach can hand the investors some really valuable perspective in decision-making and thus increase the chance for success in crypto trading. As the cryptocurrency arena continues to evolve, research and extensive analyses will become the keys to unlocking the secrets of exploring the digital gold rush.